In an effort to consolidate multiple indirect taxes into a single taxing system, the Government of India established the Goods and Services Tax (GST) in 2017. The RCM was one of many additional items that came with the new GST system as part of its “one nation, one tax” policy.

Read on to learn more about the meaning of the reverse charge mechanism under GST, the list of services under RCM in GST , and more!

Reverse Charge Mechanism (RCM) Under GST

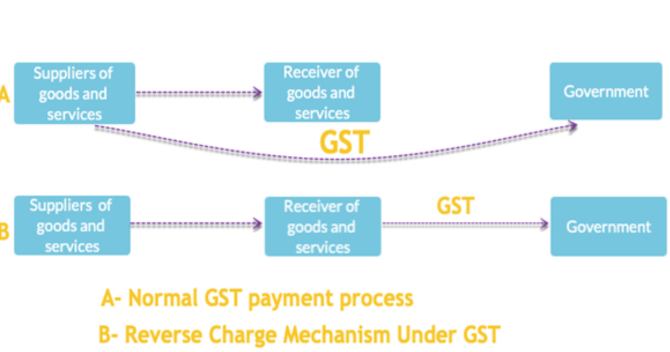

- The full form of RCM in GST is Reverse Charge Mechanism. It is an important concept under the Goods and Services Tax (GST) regime. RCM is a mechanism wherein the liability to pay tax is shifted from the seller to the buyer. It is applicable when goods and services are purchased from unregistered dealers or otherwise.

- Normally, businesses with an annual turnover of over Rs. 40 Lakh must register with the GST council. Nevertheless, under the Reverse Charge Mechanism in GST, the buyer of goods & services from an unregistered seller or supplier must register for the RCM. This is irrespective of the annual turnover threshold for businesses to register with the GST council.

- Under the GST regime, RCM applies to certain specified goods and services. The GST Council has unified the taxation system in India and has come up with RCM to ensure tax compliance by buyers and sellers. It is an important part of the GST system and applies to both Intra-State and Inter-State transactions.

How Does the Reverse Charge Mechanism Work?

- The system of RCM is simple. Under this mechanism, the buyer is liable to pay the GST on the purchase of goods and services from unregistered dealers. This is because the unregistered dealers do not have to charge GST on their sales. The buyer is then required to pay the GST and then claim the input tax credit or ITC.

- The RCM applies to certain specified goods and services. These goods and services are notified by the GST Council from time to time. Some of the goods and services which are subjected to RCM are alcoholic liquor for human consumption, legal services, services by an arbitral tribunal, and services by way of renting motor vehicles. To check the complete list of goods and services under RCM, you can visit Reverse Charge Mechanism in GST.

The RCM applies to both Intra-State and Inter-State transactions:

- In Intra-State transactions, the RCM applies to unregistered dealers located in the same state.

- In Inter-State transactions, the RCM applies to unregistered dealers located in different states.

Applicability of RCM on Goods & Services

- The RCM applies only to the specified goods and services and not to all goods and services. The seller is required to issue an invoice to the buyer with the applicable GST rate and the buyer is required to pay the GST as per the invoice. The buyer is then required to claim the input tax credit or ITC for the same.

- The RCM also applies to e-commerce transactions. In such transactions, the e-commerce operator is responsible for collecting the applicable GST from the buyers and depositing it with the government. The e-commerce operator is also responsible for providing the details of the buyers and sellers to the tax authorities.

- Time of Supply of Goods & Services Under the RCM in GST

- RCM Time of Supply (Goods)

The time of supply of goods should be the earliest of the following dates:

- The date of receipt of the goods

- The immediate date after 30 days from the date mentioned in the invoice issued by the supplier

- In case the time of supply is unclear, the entry date of the goods in the recipient’s books shall be considered

- RCM Time of Supply (Services)

In the case of services provided by the supplier, the time of supply will be determined by the earliest one of any of the following dates:

- The immediate date after 60 days from the date mentioned in the invoice issued by the supplier

- In case the time of supply is unclear, the entry date in the recipient’s books shall be considered

- Registration Rules Under RCM

- A person who is liable to pay GST under the reverse charge mechanism must compulsorily register under GST, as per section 24 of the CGST Act, 2017. They are also excluded from the threshold limitations of Rs. 20 Lakh or Rs. 40 Lakh as it will not apply to them.

Who Should Pay GST Under RCM?

- GST should be paid on the goods or services under the reverse charge mechanism (RCM) by the recipient. However, to fulfil the GST regulations, the person providing the products must specify within the tax invoice if the tax is payable under the reverse charge mechanism.

- While making GST payments under the reverse charge mechanism, it is important to keep the following points in mind

- The recipient of the goods and services can claim an input tax credit on the tax amount paid under RCM. This is applicable only if the goods and/or services purchased are to be used for business advancement and growth.

- When discharging liability under RCM, a composition dealer must pay the tax at the normal rate instead of the composition rate. They are also not eligible to claim any input tax credit on the tax paid.

- GST compensation cess may be applicable on the payable or already paid tax under the reverse charge mechanism (RCM).

Conclusion

The RCM is a mechanism which helps the government to ensure that the buyers and sellers comply with the GST laws. It also ensures that the government gets the revenue it is entitled to. It is an important part of the GST system and helps to ensure that the GST laws are complied with efficiently.

Frequently Asked Questions

Who is Required to Register for the RCM?

Any business that buys goods & services from an unregistered supplier must register for the RCM in GST, irrespective of the turnover threshold specified by the GST council.

When is the RCM applicable?

The RCM is applicable from the earliest date of supply of goods & services.