To stay in business, a company has to keep a reasonable amount of working capital on hand. One of the most critical components of every firm is working cash. Since extra working capital causes unintended stock accumulation and capital wastage, the company should precisely project its working capital. In contrast, a lack of working capital makes it difficult for the operational cycle to run smoothly, which causes the business to fall short of its obligations.

The finance manager should therefore project the appropriate level of working capital. Before determining the quantity of working capital, the finance manager must take a few elements that affect working capital requirements into consideration. We shall discover more about these elements affecting working capital in this essay.

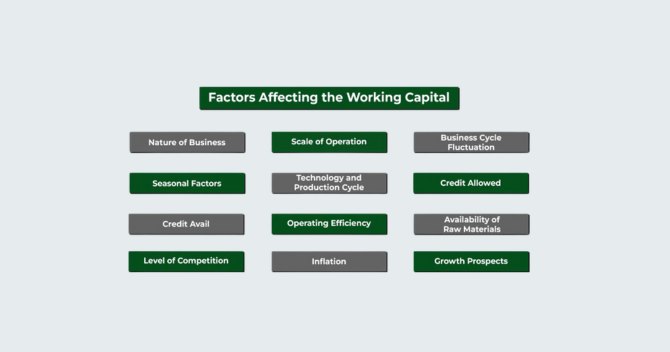

Factors Affecting a Company’s Working Capital

Determination of working capital is a highly significant task, and a company’s finance manager considers the factors determining working capital. Now we will understand these factors affecting working capital one by one.

Length of Operating Cycle

The period involved in the production is your operating cycle, and the amount of working capital is directly dependent upon the length of the operating cycle. It begins with acquiring raw materials and ends when payment is received after the sale. More working capital is needed for long operating cycles, whereas companies with short operating cycles require lesser working capital.

Size of Business

The nature and size of the business affect the requirement for working capital. Manufacturing companies require larger amounts of working capital compared to trading companies.

Seasonality of Business

Those business entities selling goods throughout the year have a constant requirement for working capital. On the other hand, the business entities that sell seasonal goods require a large amount during the season since more demand and stock need to be maintained along with the need for fast supply. During the off-season or slack season, these entities require less working capital due to very low demand.

Scale of Operations

The firms that operate at large scale have to maintain more inventory, debtors, etc. Therefore, they usually require huge working capital, whereas firms that operate on a small scale need less working capital.

Sales

Among the different factors, the size of the sales is one of the significant factors in deciding the amount of working capital. The company must maintain its current assets to increase its sales volume. In this course period, the company becomes in a position to maintain a stable ratio of its current assets to annual sales. It results in an increased turnover ratio, i.e., current assets to turnover, and reduces the length of the operating cycle. Thus, working capital will be required due to a lesser operating cycle period, and vice versa.

Competition Level

Adopting a liberal credit policy and delivering goods on time is essential when the market is competitive. Higher inventories need to be maintained, so large working capital is required. A business with less competition or a monopoly position will need less working capital since it can dictate terms depending on its requirements.

Technology and Production Cycle

If a company uses a labour-intensive technique for production, more working capital is needed because the company has to maintain sufficient cash flow for making payments to labour. On the other hand, if a company uses a machine-intensive technique for production, less working capital is needed since investment in machinery remains a fixed capital requirement, and there will be lesser operative expenses. While considering the production cycle, if it is long, then more working capital will be needed because of the longer time taken to convert raw material into finished goods. On the other hand, when the production cycle is small, less working capital is needed since lesser funds are invested in inventory and raw materials.

Collection Cycle

The collection period is the average period for the collection of sale proceeds. It depends on numerous factors, including the creditworthiness of clients, industry norms, etc. When a company follows a liberal collection cycle, more working capital will be required. On the other hand, when a company follows a strict or short-term credit policy, less working capital may be sufficient to manage.

Inventory Management

When inventories are large in size, irrespective of the slow turnover, the small-scale business will require more working capital. On the other hand, when inventories are small, the company will require a small amount of working capital, even when their turnover is quick.

After going through the above list of factors affecting working capital, it’s quite easy to understand their significance. These factors determining working capital are important for the finance manager of every company.

How to Apply for Working Capital

Now that we have gone through the factors affecting working capital requirements let’s look at the steps to apply for a working capital loan:

Step 1 – Select your preferred type of loan

Step 2 – Check eligibility

Step 3 – Evaluate the key factors

Step 4 – Acquire necessary documents

Step 5 – Apply for the loan

Conclusion

Working capital is one of the most significant concepts for every business organization. The finance manager in the company estimates their working capital and takes into consideration the above factors. Out of these factors, some are internal ones, whereas others are external factors. After considering all of them, estimating the appropriate amount of working capital is necessary. Once the exact calculation is ready and you are aware of the requirement, you can accordingly apply for working capital after acquiring the necessary documents.

Frequently Asked Questions

- What are the 4 key components of working capital?

The 4 main components of working capital are – Cash and Cash Equivalents, Accounts Receivable, Inventory, and Accounts Payable. - What are the pillars of working capital?

The pillars of working capital include – Inventory management, Receivables Management, and Payables Management. - What are the main concepts of working capital?

Quantitative and Qualitative are the two main concepts of working capital. - What are working capital and its types?

Working capital refers to the number of current assets exceeding current liabilities. The types of working capital –

- Gross Working Capital

- Net Working Capital

- Permanent Working Capital

- Temporary Working Capital

- Regular Working Capital

- Reserve Margin Working Capital

- Seasonal Working Capital

- Special Working Capital