A credit score, which consists of three digits, represents a person’s creditworthiness or dependability when borrowing money from a lender. Simply said, lenders and lending institutions give a lot of weight to your credit score. Continue reading to learn more about the CIBIL score, how it is determined, and the variables that affect it.

CIBIL Score Meaning

In India, the credit score is also commonly known as the CIBIL score, an acronym for the Credit Information Bureau India Limited. This is one of the most reliable credit rating agencies that keep track of a borrower’s debts and repayments, such as loans, credit card payments, etc. They check this information to generate a score based on repayment history and other such factors. It plays an essential role in the loan application process, as it determines the individual’s creditworthiness and track record of repayment.

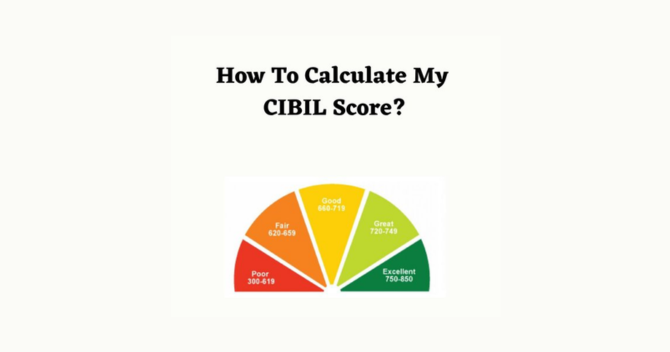

As mentioned earlier, the CIBIL score is a three-digit number that ranges from 300 to 900 points. A higher score, usually above 750, indicates that the individual is more creditworthy and has a good track of repayments. This gives the borrower leverage on getting the loan approved faster and at a better interest rate.

How is CIBIL Score Calculated

The CIBIL score calculation is primarily based on an individual’s credit history and repayment behaviour. It is calculated using a detailed and complex algorithm along with other financial activities.

The CIBIL score is calculated using the following variables:

Repayment History

This factor includes the individual’s credit accounts, such as credit cards, loans, and other forms of borrowing activities. The credit history shows the individual’s repayment behaviour over time, whether they have cleared their dues on time or if they have ever defaulted on a loan repayment. Late payments or missed EMI payments can negatively impact the CIBIL score.

Types of Credit

This variable looks at the types of credit that the individual has opted for in the past including credit cards, Personal Loan, etc. Usually, a diversified and well-maintained credit portfolio can positively impact the CIBIL score, as it exhibits the borrower’s repayment capability and ability to manage different types of credit. Instead of opting for one type of loan, you must always choose a mix of secured and unsecured loans. Some Non-Banking Financial Companies like Credit Success offer a host of different loan options to choose from based on your specific requirements.

Repayment Duration

The repayment duration considers the overall tenure of the credit and is based on your repayment timelines. Lenders use this to determine your ability to repay a loan on time and demonstrate responsible credit behaviour.

Also Read :- CRIF Vs CIBIL: Explore the Major Difference

Credit Utilization

This variable considers the individual’s credit card usage and the balance they carry on their credit cards. A high credit utilization compared to income can negatively impact the CIBIL score, as it shows high reliability on credit.

Recent Credit Inquiries

This factor considers the number of credit inquiries made on your credit report, especially if there are any discrepancies. A high number of hard inquiries can negatively impact your CIBIL score, as it can suggest that you might be in financial distress and seeking credit from multiple sources.

Using PAN Card to Check CIBIL Score

The PAN card is a key document that is required for validating and carrying out most financial transactions, including opening a savings account or applying for loans. The PAN card is also linked to your CIBIL score as it can be used to verify your identity and credit history.

When one applies for a secured or unsecured loan or credit card, the lender will use their PAN card to get their credit report from the Credit Information Bureau India Limited (CIBIL). The credit report has details about the individual’s credit history, repayment behaviour, and outstanding debt. Financiers use this information to calculate the individual’s CIBIL score and determine their credit reliability.

So, individuals must ideally check their credit scores from time to time to ensure good credit health. Furthermore, a good credit score can help in getting loans without any hassle. If you are wondering how to improve your credit score, check out ‘How to Improve Credit Score In 30 Days in India’?

Conclusion

In conclusion, the CIBIL score is a crucial factor in determining your creditworthiness. It is calculated based on several variables, including repayment history, credit utilization, length of credit history, types of credit, and recent credit inquiries. The PAN card is also linked to an individual’s CIBIL score, as it is used to verify their identity and credit history.

Maintaining a good CIBIL score is essential for individuals who want to secure loans or credit cards with favourable terms and conditions. By understanding how the CIBIL score is calculated and taking steps to maintain a good credit history, individuals can improve their creditworthiness and achieve financial stability.

We understand that maintaining a good CIBIL score is essential to secure loans or credit cards with favourable terms and conditions. To help you achieve a good CIBIL score, feel free to go through our website blogs for advice and guidance on how to maintain a good credit history. You can also check your CIBIL score for free on our website.