- Every business owner has experienced a circumstance where they have sold their products or services but have not yet been paid. The period of time between a sale and a receipt may last several months. Typically, in order to draw customers and clients, firms offer flexible payment terms and operate on credit. But how do companies keep their cash flow steady if that’s the case? For a business to cover its operating costs, it needs a consistent flow of income. Invoice financing is the most effective technique to guarantee that cash flow is not interrupted.

- In this article, we will discuss everything you need to know about invoice financing for business to ensure the smooth cash flow of your business.

What is Invoice Financing?

Invoice financing is a way to avail of short-term credit. Essentially, companies can use their pending invoices as collateral to avail of a loan. The amount that is paid on the invoice eventually goes to the lender as repayment for the financing. Invoice financing for loan capital is widely used in sectors such as transport, retail, construction, and so on. Usually, these sectors deal in a large number of high-value invoices. These companies need invoice financing so that they can maintain cash flow to conduct operations until the invoices are paid by the customers. Invoice financing is sometimes referred to as “invoice discounting” or “receivables financing”.

How Does Invoice Financing Work?

Not every lender or bank offers invoice financing for loan capital. However, the process is quite simple.

Step-By-Step Breakdown of Invoice Financing

Invoice financing for business involves the following steps:

- The first step is when you sell your goods and services and immediately invoice your customers. These invoices serve as proof that the goods have been sold and that payment is due. You will then need to ask your customers to acknowledge the invoice and commit to paying the invoice within a stipulated timeline (for example, three months).

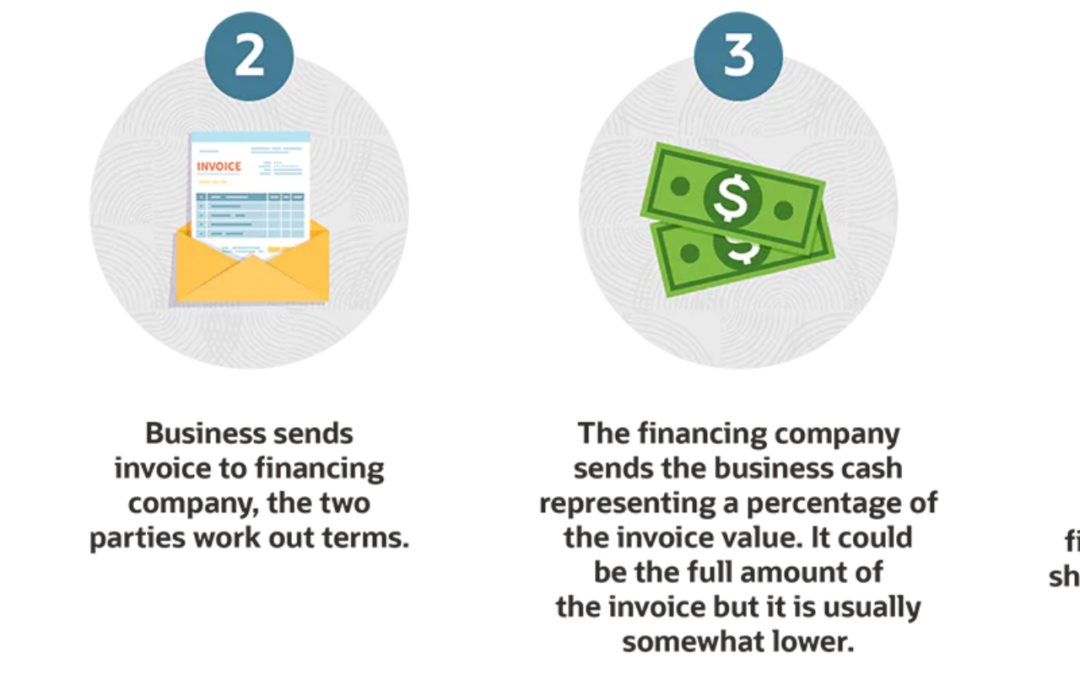

- The details of the invoice will be sent to the lender (the institution which is providing you with invoice financing services). The lender will check the invoices and determine whether the invoices are suitable for financing.

- Once the lender approves the invoices, they will provide the credit as requested. There is typically a maximum percentage of the amount due under the invoices which can be borrowed. For example, the lender may provide a maximum of 92% of the invoice amount. This amount is usually disbursed within 48 hours of the invoices being approved. The remaining amount of the invoice is considered as payment to the lender for their services.

- You can collect the payment from your customers as recorded by the invoices.

- Once you have the payment, you are required to send the required amount to the lender as repayment for the credit along with the cost of their services. For example, if you received 92% of the invoice as credit and the rest of the 8% was the cost of the credit, you will need to send 100% of the amount received from the invoice to the lender.

Also Read: Business Loan Process – A Step By Step Guide

Who is Eligible for Invoice Financing?

For invoice financing, lenders consider a variety of factors to determine your eligibility:

The financial statements of your business: The lender will check the accounts of your business to determine whether your business has sufficient turnover and whether it is a credible entity. The lender wants to ensure that your business can service the loan even in case of non-payment or delay in payment of invoices being financed.

The amount your company is proposing to borrow: The lender will determine whether the loan amount is sufficiently large to meet their eligibility criterion. Further, they will check whether the amount is too large to pose a disproportionate risk for the lender. The lender will also check the total outstanding amount of all your invoices.

The customer base of your company: The lender wants to ensure that your business is not entirely dependent on a few large customers. The more varied the customers of your business, the more likely it is that all the invoices will be paid in full.

Advantages of Invoice Financing

Cash Flow and Working Capital: The main benefit of obtaining loan capital through invoice financing is that it helps ensure that your company does not have liquidity or working capital issues. You receive the amount due on your invoice almost as soon as you raise your invoice.

Competitiveness: Invoice financing helps you improve the competitiveness of your business. This is because you can provide more flexible payment terms to your customers. Customers who receive such benefits are likely to do more business with you.

Growth: You can increase the amount of your borrowing as your business and size, or the number of your invoices increase. Lenders are willing to finance very high amounts as long as the company has enough credibility.

Ease and Flexibility: Invoice financing is quite easy to obtain. It is evident from the above section on eligibility that almost any company can make use of invoice financing. If you have recurring invoices and regular customers, it becomes even easier to avail yourself of invoice financing. Further, lenders do not usually ask for any collateral apart from your invoices, so you don’t have to worry about offering security.

Wrapping Up

Invoice financing for business can be right for you if your customers do not pay your invoices immediately. If you need to wait for a few months to receive your dues, invoice financing can be the perfect way to ensure that your business runs smoothly. Further, this type of financing is quite easy to obtain and is highly cost-effective. Invoices are generally deemed to be safe as collateral which makes them less risky for the lenders. Don’t let short-term cash crunches affect your growth prospects. Avail of invoice financing today.

FAQs

Why use invoice finance?

Invoice finances or invoice financing is an excellent option for businesses to improve cash flow, pay employees and/or suppliers, etc., especially when facing challenges in obtaining other forms of credit. It is also helpful during certain situations, such as delays in receiving money from customers.