Debt may be a heavy burden that has an impact on one’s financial stability and mental health. Getting out of debt becomes a primary priority for many people, but the process can be intimidating. Fortunately, the Debt Snowball Method provides a clear path towards financial independence and freedom by taking a calculated approach to debt repayment. In this post, we’ll examine the Debt Snowball Method, what it is, and how to apply it to debt repayment. Continue reading.

What is the Debt Snowball Method?

- The Debt Snowball Method, popularized by personal finance expert Dave Ramsey, is a debt repayment strategy focused on paying off the smallest loan first. Once that debt is cleared, the money used for its payment is redirected to the next smallest debt, creating a snowball effect. This process continues until all accounts are paid off. As you roll the money from one debt to the next, the amount “snowballs,” leading to larger payments and accelerated reduction of outstanding debt.

- Unlike some other debt repayment approaches that prioritize interest rates or overall balances, the Debt Snowball Method focuses on building momentum through small victories. Hence, the process gets its name from the idea that as you pay off the smallest debts, the snowball gains momentum, allowing you to tackle larger debts with increased confidence and financial resources. This method is highly motivational, as it offers a sense of accomplishment with each debt paid off, encouraging you to stay committed to the journey.

How Does the Debt Snowball Method Work?

The debt snowball method is a popular strategy for paying off debt that focuses on building momentum through small victories. Here’s how it works

- List All Debts: To begin, create a comprehensive list of all your debts, including credit card balances, Personal Loans, student loans, and any other outstanding obligations. Organize them from the smallest balance to the largest.

- Set a Budget: Establish a realistic budget that outlines your income, expenses, and discretionary spending. This budget will serve as the foundation of your debt repayment plan.

- Minimum Payments: While concentrating on the smallest debt, continue paying minimum due amounts on all your other outstanding debts. Allocate any surplus funds to the smallest debt, accelerating its repayment.

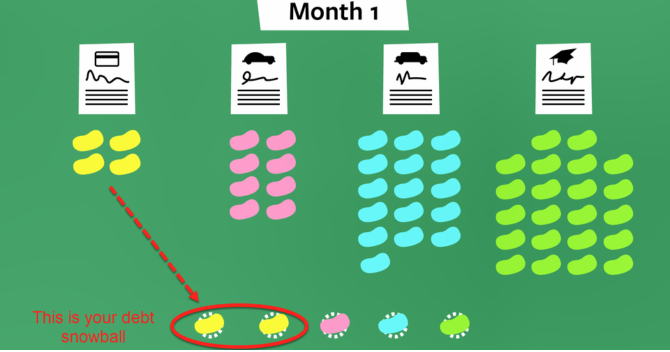

- Snowballing Effect: Once the smallest debt is paid off, take the total amount you were paying toward it (including the minimum payment) and add it to the minimum payment of the next smallest debt on your list. This creates a snowballing effect, enabling you to pay off the subsequent debts faster.

- Repeat and Progress: As each debt is paid off, repeat the process by rolling the freed-up funds into the next debt on the list. As time goes on, the amount you can dedicate to each subsequent debt increases, further accelerating your progress.

- Celebrate Milestones: Celebrate your achievements along the way, such as paying off a credit card or clearing a loan. Recognizing these milestones will help keep you motivated and committed to your debt repayment plan.

- Stay Disciplined: The Debt Snowball Method requires discipline and persistence. Avoid accumulating additional debt and stay focused on your financial goals.

The method relies on the psychological boost of clearing smaller debts quickly, which motivates you to stay on track and tackle larger debts with time. Ultimately, it helps you become debt-free more efficiently.

Also Read – What is Debt Financing? Meaning, Types & Its Advantages and Disadvantages

Advantages of the Debt Snowball Method

- Motivating Progress: By targeting the smallest debts first, you quickly experience a sense of accomplishment, motivating you to continue the journey.

- Simplified Strategy: The Debt Snowball Method is straightforward and easy to understand, making it accessible for anyone looking to manage their debt effectively.

- Psychological Benefits: As you eliminate smaller debts, you reduce the number of creditors, leading to decreased stress and anxiety associated with multiple outstanding obligations.

- Increased Cash Flow: As debts are paid off, the amount available for debt repayment grows, allowing you to tackle larger debts with more significant resources.

- Positive Behavioural Shift: The Debt Snowball Method promotes responsible financial behaviour and encourages you to make smarter decisions about spending and saving.

Conclusion

The Debt snowball method is a powerful and effective strategy for repaying debt. By targeting smaller debts first and building momentum, this approach empowers individuals to take control of their financial situation and work towards a debt-free life. It requires discipline, commitment, and a willingness to make financial changes, but the benefits of reduced stress, increased cash flow, and improved financial well-being are well worth the effort. Take the first step today, list your debts, set a budget, and begin your journey towards financial freedom with the Debt Snowball Method.

Frequently Asked Questions

Is debt snowball good?

The debt snowball method can be beneficial for individuals who need motivation to pay off debt quickly by starting with small victories, but it may not always be the most financially efficient approach due to potentially higher interest costs compared to other strategies.

What is the snowball formula?

The snowball method of repaying debt has no formula, but it has steps that need to be followed. Here are the steps

- List all your debts from smallest to largest irrespective of interest rates.

- Pay the minimum required amount for each debt, except for the smallest one.

- Allocate as much funds as you can to your smallest debt and try to pay it off fully.

- Then focus on the next smallest debt and follow these steps until you are debt free.

- If you want to figure out how long it will take you to pay off your debt, you can use a debt snowball calculator. You can easily find it online.

How can I pay off my debt fast?

Here are some effective ways to pay off your debts fast

- Shorten the length of your loan if you have the required funds for repayment.

- Reduce unnecessary expenses.

- Find effective ways to increase your income.

- Stop adding more debt.

- Consider using debt snowball and debt avalanche repayment methods if you have multiple debts.

- A debt consolidation loan can also be a great option.

What are the key strategies for paying off outstanding debt?

The three effective strategies for repaying your debt are debt snowball, debt avalanche, and debt consolidation. Perform a detailed analysis of your debt and then evaluate which of these strategies would be an ideal option for you.