- A consumer-focused economy that appears to serve the varied requirements of a heterogeneous mix of audiences has been developed over the past few of decades as a result of ongoing innovation and development across a wide range of industries. People everywhere have a ton of options, whether it be for consumer items or financial products, which some may even view as a blessing.

- However, in a market flooded with multiple financing options to choose from, it can often seem difficult to find the best choice that suits the funding or financial needs of a consumer. To combat this confusion, it is important to be aware and gain as much information as possible on the various funding and financing products made available to you.

- Some popular financing options for individuals include Personal Loan and Buy Now Pay Later (BNPL), apart from others. A Personal Loan is the most popular loan type and financing option available to individuals, while BNPL is a product that is fast gaining in popularity. Hence, it makes sense to examine these further to find out the key benefits of each and how they differ from each other.

What is Buy Now Pay Later (BNPL)?

Buy Now Pay Later (BNPL) is often termed as a micro-loan that is made available to customers during instant payments for small-ticket purchases at the point of sale. These are unsecured loans that are required to be paid back by customers within a specified period of the repayment cycle.

Benefits of BNPL

BNPL has been often used by mostly e-commerce vendors and sites among others to attract more customers and make the entire purchase experience a hassle-free process. Some of its key benefits include:

Accessible to a Diverse Customer Base

BNPL is gradually becoming the go-to financing option for customers who are looking to make a quick purchase without worrying about upfront payment. It is suitable for any individual irrespective of their background or financial capabilities, which means it reaches a wide range of customers.

Instant Credit

As previously mentioned, BNPL offers instant credit. This means customers don’t have to wait for an extended period to finance their purchase when they are low on funds or be compelled to pay upfront. They can simply buy the product of their choice and pay it back in easy installments or EMIs over a predefined repayment cycle.

Increase in Affordability of Products

BNPL makes products virtually more affordable for customers who may otherwise not be willing to purchase due to a lack of funds or finances at the point of sale. It creates a sense of assurance, safety, and ease that motivates individuals to buy what they want without any second thoughts.

What is Personal Loan?

A Personal Loan is a form of loan or financing option that allows individuals to meet any of their immediate financial requirements. This loan can be used to finance any personal need, such as medical emergencies, home renovation, marriage expenses, or specific goals.

Benefits of Personal Loan

Personal Loans can come across as a blessing in disguise for those in need of urgent funding for any individual reason. Let us further explore the diverse benefits that make it an excellent financing option!

No Collateral or Security Pledging Involved .

Personal Loans are unsecured, which means an individual will not have to pledge any collateral or security in order to secure the loan. Its eligibility mainly depends on the applicant’s ability to pay it back in time. Moreover, it also creates a sense of relief for the person applying for the loan as it doesn’t put them under additional stress and simply focuses on funding their needs

Less Paperwork

Since there are no collaterals required with a Personal Loan, it usually involves minimum documentation. Instead of having to meet an extensive list of eligibility criteria and documentation, individuals can simply apply if they meet the basic pre-determined conditions, and as a result, enjoy a faster loan processing experience.

Flexible Repayment Cycle

Some financial institutions like creditsuccess offer flexible repayment tenure with their Personal Loan of up to 60 months (five years), which gives an individual ample time to pay it all back according to their budget and repayment plan. It is a comfortable and convenient option for people from all levels of society.

BNPL Vs Personal Loan: Major Differences

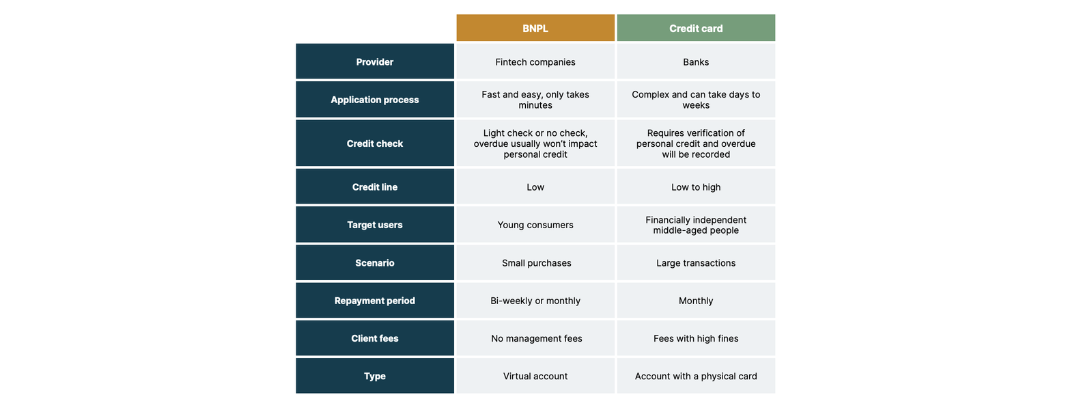

While both are customer-focused financing options, there are some key differences between BNPL and Personal Loans. Let us check them out!

Pre-approval Criteria and Eligibility

BNPL does not have an extensive checklist and pre-approval process as the lender directly pays the merchant on the customer’s behalf. All a customer has to do is pay back the amount over the pre-determined repayment period.

On the other hand, Personal Loan applicants have to meet some pre-defined criteria to be eligible for the same. It requires determining the loan applicant’s creditworthiness, i.e., their ability to pay it back within the stipulated repayment cycle.

Repayment Cycle

The repayment tenure for BNPL customers typically ranges anywhere between 14 and 90 days, depending on the lender. In essence, customers can buy now pay later in EMIs according to the set tenure.

On the other hand, Personal Loan customers get to enjoy greater flexibility in terms of repayment as most financial institutions generally provide a maximum repayment tenure of up to 60 months (five years).

Loan Amount

Customers who opt for Buy Now Pay Later can receive a maximum credit of up to Rs. 1 Lakh depending on the type of small-ticket purchase. It could be for any point-of-sale product like electrical appliances.

Those who apply for a Personal Loan can be eligible to receive up to Rs. 30 Lakh depending on their requirement, credit score, loan repayment capability, and financial background. Personal Loans are for big-ticket purchases, and so, have a higher loan amount than BNPL.

Conclusion

Now that the main differences between BNPL and Personal Loan as well as their respective benefits have been established, Personal Loan does take the lead in terms of security and flexibility. Do consider all your options before choosing the right one.

So, what are you waiting for? Go ahead and use this new-found financial knowledge to your advantage.