In an effort to establish a unified taxation system that could be applied over the entire nation, or “one nation, one tax,” the Goods & Services Tax (GST) was adopted in India in July 2017. One significant difference between the GST and its predecessor, the VAT (Value Added Tax), is that the GST is now collected at the point of consumption rather than the place of origin.

The central and state level indirect taxes, CGST and SGST, have been consolidated as a result of India’s taxation system’s simplification. Learn more about GST, CGST, and SGST, their definitions, and how they differ.

What is the Goods & Services Tax?

The Goods and Services Tax (GST) is a comprehensive tax that is levied on the supply of goods and services. It is a dual-level tax system, comprising the Central GST (CGST) and State GST (SGST). It has replaced the multiple taxes previously levied by the Central and State Governments of India.

Some of the biggest benefits of GST for all kinds of industries and businesses have been:

Uniformity in Taxes

- As previously stated, the GST reform has allowed the Central and State government to create a uniform taxation system.

Composition Scheme for SMEs/MSMEs

- Under the Composition scheme, any small business owner with a turnover of less than ?1.5 Crore can pay the GST at a set rate of turnover.

Simple Registration Procedure

- The process for GST registration is quite simple and straightforward for businesses.

What is CGST? – Meaning & Definition

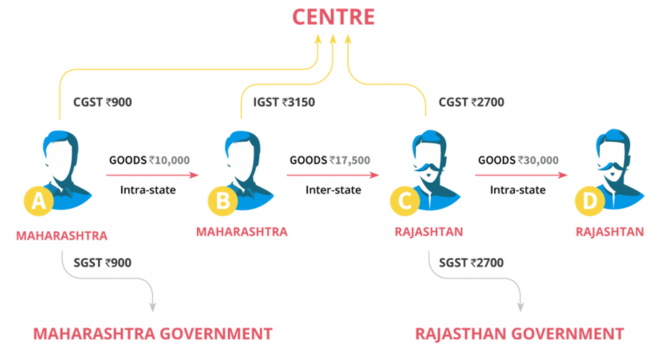

The full form of CGST stands for Central Goods and Services Tax. It is a type of tax imposed by the Central Government on the supply of goods and services within a state. It is levied on the value of the goods and services supplied.

The CGST is collected by the Central Government and the revenue is used to finance various activities.

What is SGST? – Meaning & Definition

The full form of SGST stands for State Goods and Services Tax. Just like CGST, it is imposed by the State Government on the intrastate supply of goods and services. It is levied on the value of the goods and services supplied for end consumption.

What are the Differences Between CGST and SGST?

While both CGST and SGST are quite similar since they are part of the Goods and Services Tax, there are some basic differences. Let’s take a look:

What is CGST & SGST

- Tax Collection – The primary difference between CGST and SGST is that CGST is imposed by the Central Government and SGST is imposed by the State Government. The Central Government collects the CGST, and the State Government collects the SGST. Both taxes are collected on the same value of goods or services supplied.

- Revenue – Another difference between CGST and SGST is that the Central Government can share the revenue collected from CGST with the State Governments. The Central Government distributes the revenue among the States according to the recommendations of the GST Council. The State Governments, however, cannot share the revenue collected from SGST with the Central Government.

- Taxes incorporated – The indirect taxes incorporated or subsumed within CGST and SGST are as follows:

- CGST: Central surcharges & CESS, Central excise duty, other Central indirect taxes

- SGST: Value Added Tax (VAT), State surcharge & CESS, other State taxes

Things to Keep in Mind as a Business Owner

Here are some key considerations that business owners in India should keep in mind:

Registration for GST – GST registration is mandatory for both goods-based and services-based businesses if their annual turnover exceeds the set limit. However, those who are exempt from mandatory registration can still choose to voluntarily register for GST.

Different Slabs of GST – There are mainly four GST tax slabs for different goods and services. These can be categorized under the tax slabs of 5%, 12%, 18%, and 28%.

Easy Process – With a uniform taxation system in place, it will be easier for entrepreneurs to pay their taxes.

Filing GST Returns – All businesses and entrepreneurs are required to file their GST returns on the GST portal.

Compliance Rating – GST compliance ratings help identify businesses that regularly adhere to the rules and guidelines of GST.

Conclusion

To summarize, the CGST and SGST are two different types of taxes imposed by the Central and State Governments, respectively. They are both levied on the value of goods and services supplied within a state. The Central Government collects the CGST, and the State Government collects the SGST. The Central Government has the power to make laws and regulations related to CGST, while the State Governments have the power to make laws and regulations related to SGST. Businesses should know all aspects of GST and adhere to the rules when filing GST returns.

Frequently Asked Questions

Q.1: What is the full form of SGST?

The full form of SGST is State Goods & Services Tax. It is imposed by the State Government in India on the intrastate supply of goods and services.

Q.2: What is the full form of CGST?

The full form of CGST is Central Goods & Services Tax. It is imposed by the Central Government in India on the supply of goods and services.

Q.3: Who collects the CGST amount?

The CGST amount is collected by the Central Government on the value of goods and services supplied to a buyer.

Q.4: Who collects the SGST amount?

The SGST amount is collected by the State Government on the value of goods and services supplied to a buyer.

Q.5: How is GST calculated?

The Goods & Services Tax (GST) can be calculated as per the different tax slabs as specified by the Government. The basic formula for calculating GST is as follows:

- GST Amount = (The original cost x % of GST)/100.

- To calculate the net price, add the GST amount to the original cost.